Mastering income tracking as a creator

Tracking your income as a content creator is not only essential for financial stability but also a proactive approach towards securing your future. As content creators often operate as self-employed individuals, maintaining a comprehensive record of income sources becomes crucial for effective budgeting and expense management. Creators have the opportunity to create income through various revenue streams. Given the diverse sources of potential income available to creators, their financial success relies heavily on multiple streams.

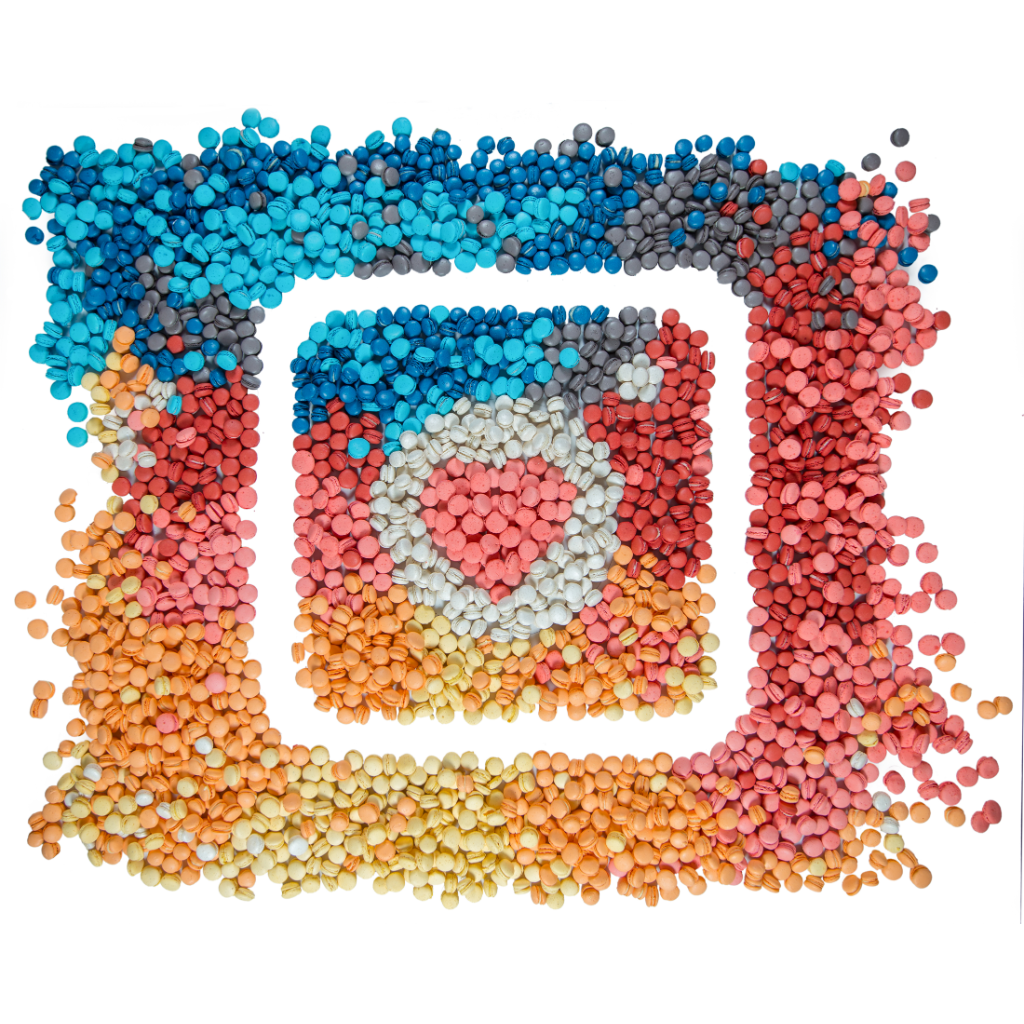

According to the Influencer Marketing Hub survey, we can see how much creators are making annually solely from their content.

Source: Influencer Marketing Hub

By neglecting proper financial tracking, creators expose themselves to the potential pitfalls of financial mismanagement, highlighting the importance of meticulous financial monitoring and planning to mitigate such risks. Not keeping track of your money as a creator can be really risky. If you don’t keep tabs on your finances, you might get surprised by unexpected taxes and end up having to pay more than you expected. You could also miss out on getting paid if you forget to follow up on invoices. It’s important to know how much money is coming in so you can make plans for growing your business and managing your personal budget. If you don’t track your finances, you might miss out on opportunities to earn more money because nobody will support your financial goals.

To embark on this journey, let’s delve into some valuable tips and strategies:

Individual bank account

Congratulations on earning money from your creative work! Now, it’s important to find a suitable place to keep your earnings, and being strategic about this can save you a lot of time and money.

First and foremost, it’s advisable to open a separate bank account dedicated solely to your creative endeavours. When it comes to your creator income, you’ll need to allocate some for taxes, some for business expenses, and of course, some for personal spending. Think of it as putting your cash in different boxes—it’s a safer and more reliable way to manage your money.

Mixing all your incomes together can be as chaotic as a mixtape, where you lose track of what’s playing next or why certain songs ended up on that particular album. This multifaceted approach to organising your accounts empowers you with enhanced control over your funds, enabling seamless allocation, budgeting, and savings strategies that can contribute to your long-term financial well-being.

Effective Tracking

The diverse income streams of a content creator, such as brand collaborations, product endorsements, ad revenues from platforms like Instagram or YouTube, sponsorships, and direct client payments, demand a systematic approach for effective tracking.

Implementing a well-structured system is imperative given the significance of being a creator. Kosmc Income Dashboard tool allows creators to effectively track the various sources of income flowing in and also the expenses in just a click of a button.

It’s important to track these accurately in real time so you don’t miss any savings opportunities.

By implementing a clear demarcation between your business expenses and personal expenses, you not only foster an organised approach to budgeting the resources required for your entrepreneurial ventures, but you also fortify your readiness for the arrival of tax season. The segregation of these expenses serves a dual purpose: it facilitates a comprehensive understanding of your business’s financial landscape and, importantly, enables you to take advantage of tax deductions.

Retain Documentation:

In addition to maintaining a separate bank account, keeping meticulous records of your expenses and income sources is of utmost importance. For instance, organising invoices in a designated folder or maintaining an Excel sheet to document income sources can provide valuable insights. This systematic approach empowers you to identify which brand collaborations contribute significantly to your growth and guides you towards making informed investments in your future. You can create Excel sheets with categorised columns for dates, months, projects, and income amounts, using formulas to calculate your profits. Use Kosmc Income Dashboard tool to track it all. Leveraging technology to automate and streamline your tracking processes can be immensely beneficial. Embracing technology enables you to alleviate your workload and generate comprehensive reports effortlessly.

- Retain your receipts as a proof of business related purchase.

- Keep documents that provide evidence of payment made to individuals or entities for business purposes. This could include receipts or records of electronic funds transfers.

- Preserve account statements from your bank or financial institutions, showcasing transactions related to your business expenses.

- Maintain receipts and statements from credit card transactions that pertain to your business expenses.

- Invoices You sent.

Some examples of business expenses include:

- Equipment for your content creation such as a mic or phone stands or phone tripods, ring light and props to enhance your content quality.

- Travel expenses if your content creation requires you to travel. Tickets to destinations, food bills, hotel bills and other travel related expenses.

- Editing softwares and graphic design tools.

- Expense related to promoting your content through digital platforms

- If your business requires using a cell phone, the portion of your cell phone bill that corresponds to business-related activities can be considered as a business expense.

- Expenses incurred for attending courses, workshops, conferences, or purchasing educational resources such as ebooks to enhance your skills and knowledge as a creator.

- If you sell merchandise or physical products, expenses related to shipping, packaging, and postage for delivering those items to customers. By recognizing and tracking these various types of business expenses, you can better manage their finances, accurately report income for tax purposes, and maximise deductions to optimise their financial well-being.

Planning Taxes

Furthermore, planning for taxes in advance is crucial. If you are experiencing substantial earnings, consider using the Kosmc Tax calculator that can be an excellent way to maintain accurate financial records and ensure compliance with tax regulations.

Also, streamline the payment process by establishing a standardised invoicing system and utilising tools such as Kosmc Invoicing for content creators

Remember, tax calculations can be intricate, and it’s important to ensure accuracy to avoid any penalties or discrepancies. Utilising tax calculation tools and consulting with professionals can provide valuable support in navigating the complexities of creator taxation and help ensure compliance with tax regulations.

By adhering to these practices and maintaining all records, you can establish a solid foundation for tracking your income as a content creator. This meticulous approach will provide you with valuable insights into your most lucrative income sources, allowing you to allocate your energy and resources efficiently.

Explore Apps on www.Kosmc.ai

Income Dashboard Invoicing

Manage Your Finances Create & Send Invoices

Leave a Reply